5 Steps to File a Roof Damage Insurance Claim

Finding roof damage after a storm comes through isn’t a fun experience. Dealing with the insurance company and going through the claim process is even less fun.

But if you’ve never had to file a claim, you probably don't know the steps to take or where to start. That’s where we come in.

For over 30 years, the team at Bill Ragan Roofing has provided transparent advice to homeowners dealing with roof damage and their insurance company. Because of this, I’ll break down the steps you should take to file a roof damage insurance claim.

This article walks you through the following 5 steps when filing a claim for roof damage:

- Assess and document any roof damage you can see

- Check your policy to find out if roof damage is covered

- Contact your insurance company to start the process

- Get a storm damage roof inspection

- Get a quote for the scope of work

1. Assess and document any roof damage you can see

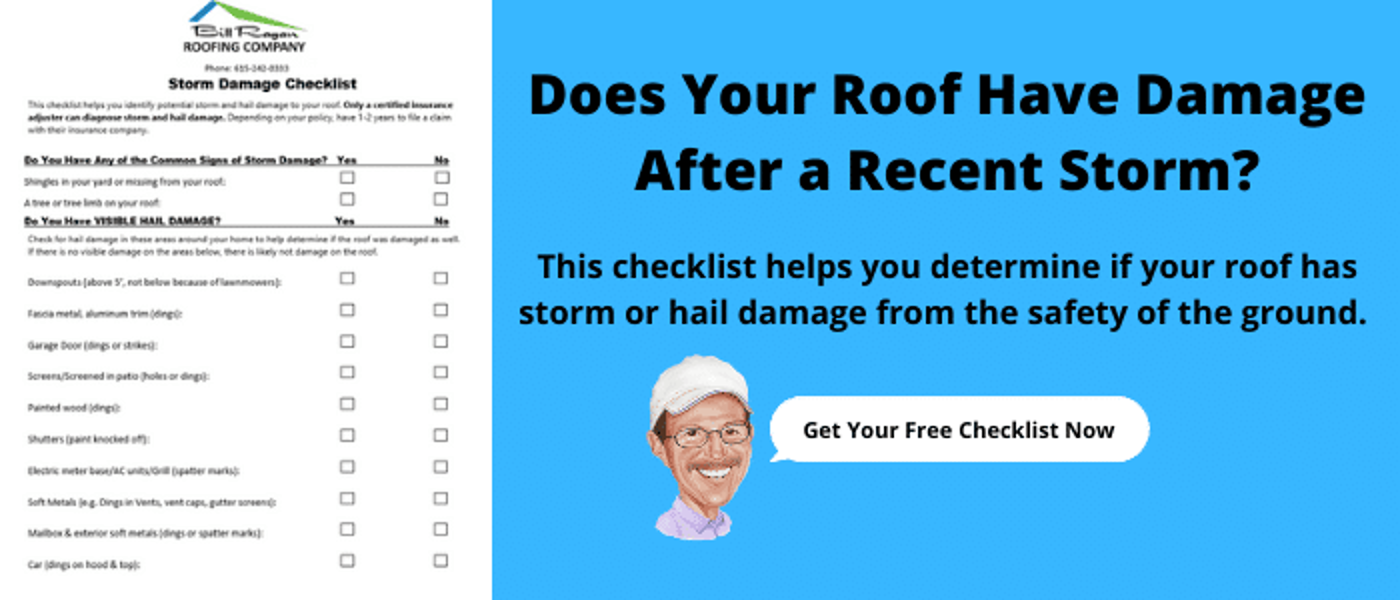

The first step to filing a roof damage insurance claim is to make sure you have a viable claim. While this does nothing to get the claim approved, it helps you determine if it’s worth starting the process.

For wind damage, look for missing, creased, or sliding shingles while walking around your property. For hail damage, look for collateral damage on the objects at the ground level to learn if your roof was possibly impacted.

Below are the following areas to check for collateral hail damage:

- Dents in downspouts (Above 5 feet, so it can’t be blamed on a lawnmower)

- Dings or strikes to your garage door

- Holes in your window screens

- Dings to any painted wood or shutters

- Splatter marks or dings to your electric meter, AC unit, or grill

- Dents to your mailbox and other soft metals on your property

If you’re here, you obviously saw signs of storm damage to your roof. However, it’s important to photo-document the signs of roof damage as much as you can from the safety of the ground.

2. Check your policy to find out if roof damage is covered

After determining if you want to move forward with the claim, the next step is to check if it’s even covered in your policy. Most homeowners insurance policies protect your roof in the event of hail, wind, or fallen tree damage from storms.

Just know that some policies have exclusions that could impact the type of damage covered. After ensuring that the roof damage is covered, you need to check if your policy is an Actual Cash Value policy or Replace Cost Value policy.

Your policy determines your payout and if the insurance company will pay for a full roof replacement.

Actual Cash Value policy

An Actual Cash Value (ACV) policy gives you a payout for the depreciated value of your roof. With this policy, your insurance company only has to give you what your roof is valued at the time of the claim.

This policy will not cover the full cost of a new roof, which leaves you paying for the rest of it out-of-pocket. You will not get a quality roof with an ACV payout, but you can probably find a roofer willing to do it for the amount insurance gives you.

However, this guarantees using cheap materials and labor that sets your roof investment up for premature failure from the start.

Replacement Cost Value policy

A Replacement Cost Value (RCV) policy gives you what it costs to replace your roof with a brand-new version of itself. Once your claim is approved, the insurance company will send a check for the actual cost value of your roof while holding back the recoverable depreciation.

After your roof replacement, you’ll provide proof that it was done per the claim, and then you’ll get a second check covering most or the rest of the cost. But remember, the insurance company only pays to restore your new roof to a brand-new version of itself.

This means if you want to add upgrades, like going from 3-tab asphalt shingles to architectural asphalt shingles, you’ll pay the difference yourself.

3. Contact your insurance company to start the claim process

After checking your policy, the next step is to contact your insurance company to file a claim for roof damage. You’ll pass on all the relevant information, and then your insurance company will either send out an adjuster or tell you to find a roofing contractor.

Which one they tell you to do is usually based on location, the insurance company, and the number of claims being filed. Just know that you should already have a trusted roofing contractor handy.

They’ll be able to guide you and help prove you have a viable claim if there’s actual roof damage. Even if they send out an adjuster first, having your roofing contractor there for the adjuster appointment is also a good idea.

4. Get a storm damage roof inspection

The next step after contacting your insurance company is a storm damage roof inspection. Both your insurance adjuster and roofing contractor need to perform their own inspections.

Whoever goes out there first will mark any roof areas with missing shingles, granule loss, hail marks, dents in metal, and anything else that looks like possible storm damage with chalk. This makes it easier to see the damage and creates clear reference points when reviewing your claim.

After marking the roof damage, they’ll take pictures of everything to submit to the insurance company. After your roof is inspected, they should also document any signs of collateral damage on the ground like you did earlier.

Remember, it’s a good idea to have your roofing contractor there during the adjuster inspection. This is simply because your adjuster isn’t a professional roofer, so mistakes do happen if they don’t know where or what to look for.

It’s also nice to have someone on your side if the adjuster tries to push back on clear roof damage caused by storms.

5. Get a quote for the scope of work

If your claim is approved, you’ll get your payout (minus your deductible) for your roof replacement. If you have an ACV policy, you’ll get a quote from your roofing contractor for the scope of work.

You’ll use the insurance check to cover as much as possible and then make up the price difference out-of-pocket. But if you have an RCV policy, you’ll get a scope of work from the insurance company to restore your old roof to a brand new version of itself.

Your roofing contractor has to follow this scope of work so you get the recoverable depreciation to cover the full cost. But this doesn’t mean they can do the job for the amount insurance says it costs to replace a roof.

The truth is most roofing contractors’ estimates end up being more than insurance’s initial estimate. This is because most insurance estimates leave off important things like overhead and profit on top of other things a business needs to stay open.

However, you can get these line items covered by putting in the effort to supplement your claim. This takes time and patience to ensure you get everything you're owed for paying your premiums.

If you’re happy with the payout and don’t want to deal with supplementing, you’ll only pay your deductible plus the difference in the estimates. Now, you can probably find a roofing contractor willing to do the work for the amount insurance gives you initially.

However, there’s a reason they’re willing to do it for that amount when other companies aren’t.

How do you find a reputable roofing contractor to handle your roof damage insurance claim?

After reading this article, you know what steps to take to file a claim when a storm damages your roof. If you think you have a viable claim, you’re ready to reach out to your insurance company to start the process.

But, as I’m sure you noticed, the roofing contractor you hire plays an important role in the insurance claim process. Unfortunately, insurance work brings out the worst in the roofing industry.

You need a partner in the process, not a wolf in sheep’s clothing looking to take advantage of you during an overwhelming time. That’s why I wrote another article with the tips you need to hire a reputable roofer specifically for roof damage insurance claims.

Here are 7 Tips to Hire a Roofing Contractor for a Roof Damage Insurance Claim so you have the confidence to make the best hiring decision.