We all know how unpredictable the weather is in Nashville and the rest of Middle Tennessee for most of the year. But a weather-related event we can count on every year is one or two damaging, severe storms.

Unfortunately for homeowners, this usually brings roof and other exterior home damages. I understand how stressful this can be as a homeowner myself, but take a deep breath.

The important thing to keep in mind is that your home is covered by insurance, and any damage is temporary. You only need to worry about what to do to get your storm-damaged roof taken care of by a trusted professional.

For over 30 years, the team at Bill Ragan Roofing has guided and helped homeowners in Nashville and surrounding Middle Tennessee areas with any insurance-related questions or headaches. Now, I want to put pen and paper to help as many homeowners as possible.

This article answers the following questions:

- What kind of roof damage do storms cause in Nashville, TN?

- What should you do when a storm damages your roof in Nashville, TN?

What kind of roof damage do storms cause in Nashville, TN?

Here in Middle Tennessee, wind and hail are the two main causes of roof damage caused by storms. Straight-line winds during thunderstorms rip shingles right off your roof, especially if they’re improperly installed.

(Left: hail damage; Right: wind damage)

(Left: hail damage; Right: wind damage)

We also get the occasional hail storm, but the hail needs to be around 1” in diameter for it to cause noticeable roof damage. Because we’re in the Ohio Valley region, we do get the occasional tornado.

Obviously, a tornado hitting your roof will cause extensive damage from strong winds, hail, and/or fallen trees.

What should you do when a storm damages your roof in Nashville, TN?

Now that you know the kind of roof damage storms can cause, you’re ready to learn what to do about it. Of course, you’ll want the damage taken care of.

But once you know your roof has storm damage, you have homeowner’s insurance to get repairs or an entire new roof. Below are the things you should do when a storm damages your roof.

Assess and document any roof damage you can see

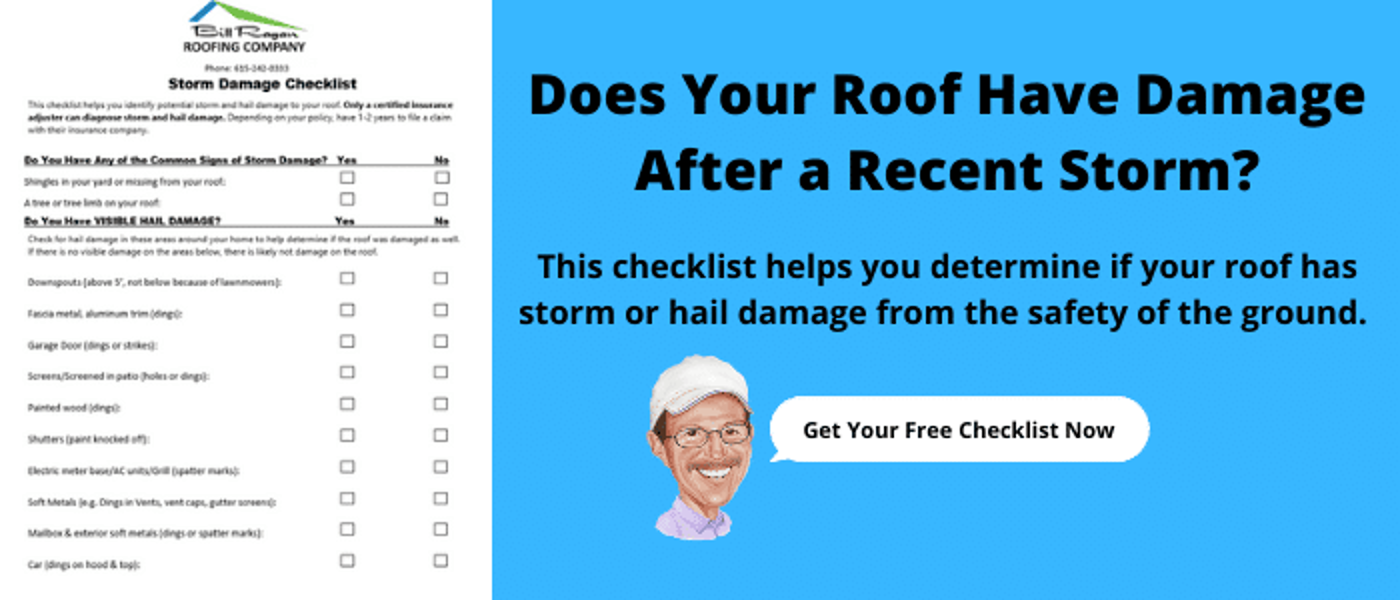

Once you suspect or notice damage, you should document everything you see. This gives you an idea if it’s worth filing, while also giving your insurance company and roofer an idea of what the issue is.

For wind damage, look for missing, creased, or sliding shingles while walking around your property and looking at your roof. For hail damage, look for collateral damage on the objects at the ground level to learn if your roof was possibly impacted.

Below are the following areas to check for collateral hail damage:

- Dents in downspouts (Above 5 feet, so it can’t be blamed on a lawnmower)

- Dings or strikes to your garage door

- Holes in your window screens

- Dings to any painted wood or shutters

- Splatter marks or dings to your electric meter, AC unit, or grill

- Dents to your mailbox and other soft metals on your property

If you’re here, you obviously saw signs of storm damage to your roof. However, it’s important to photo-document the signs of roof damage as much as you can from the safety of the ground.

Check your policy to determine if roof damage is covered

Once you know your roof has storm damage, you need to check your policy to determine if and what exactly is covered. Luckily, most homeowners insurance policies protect your roof in the event of hail, wind, or fallen tree damage from storms.

However, some policies could have exclusions that impact the type of damage covered. After ensuring the roof damage is covered, you need to check if your policy is an Actual Cash Value policy or Replacement Cost Value policy.

The policy you have determines your payout and if the insurance company will pay for a full roof replacement.

Actual Cash Value policy

An Actual Cash Value (ACV) policy gives you a payout for the depreciated value of your roof, which means you’ll only get what your roof is valued at the time of the claim.

This policy will not cover the full cost of a new roof, leaving you paying for the rest of it out-of-pocket. Unfortunately, you can find a roofer willing to do it for the amount an ACV policy provides.

However, I guarantee you’ll get cheap materials and labor that set your roof investment up for premature failure.

Replacement Cost Value policy

A Replacement Cost Value (RCV) policy gives you what it costs to replace your roof with a brand-new version of itself. You’ll get a first check for the actual cost value of your roof while the insurance company holds back the recoverable depreciation.

Once your new roof is installed and proof is provided that it was done per the claim, you’ll get a second check covering most or the rest of the cost. Just keep in mind that the insurance company only pays to restore your new roof to a brand-new version of itself.

Contact your insurance company to start the claim process

While or after checking your policy, you need to contact your insurance company to file a claim for roof damage. You’ll give them the relevant information, and they’ll either send out an adjuster or tell you to find a trusted roofing company.

Which one you do is usually based on location, insurance company, and the number of claims being filed at the time. Either way, having a trusted roofing company on standby to guide you during the process is a good idea.

Even if they send out an adjuster first, having a roofer you trust there for the adjuster appointment is a good idea.

Get a storm damage roof inspection from a local Nashville roofing company

After talking to your insurance company, it’s time for a storm damage roof inspection. Both your insurance adjuster and roofer need to perform their own inspections.

Whoever goes out there first will mark roof areas with missing shingles, granule loss, hail marks, dents in metal, and anything else that looks like possible storm damage with chalk. This creates clear reference points to easily identify roof damage when reviewing your claim.

After marking the roof damage, they’ll take pictures of everything on your roof and also any collateral damage on the ground, as you did earlier, to submit to the insurance company. As I said earlier, having your roofer there during the adjuster inspection is a good idea.

This is simply because adjusters make mistakes, and it’s nice to have someone on your side if they try to push back on clear roof damage. Just know that it’s absolutely crucial to hire a local Nashville roofing company to avoid bad storm chasers and to utilize matching laws if needed.

Get a quote for the scope of work to fix or replace your storm-damaged roof

Once your claim is approved, you’ll get a payout (minus your deductible) for your roof replacement. For an ACV policy, you’ll get a quote from your local Nashville roofing company and use the insurance check to cover as much as possible before making up the price difference out-of-pocket.

For an RCV policy, you’ll get a scope of work from the insurance company to restore your old roof to a brand-new version of itself. Your roofing company must follow this scope of work exactly so you can get the recoverable depreciation to cover the full cost.

Unfortunately, it’s incredibly rare for insurance to provide enough in their initial estimate because they leave off important things like certain materials, a roofer’s labor costs, and overhead and profit that a company needs to stay open. That’s why most reputable Nashville roofing companies’ estimates end up being more than insurance’s initial estimate.

Luckily, you can get these line items covered by being patient and putting in the effort to supplement your claim. But if you’re happy with the payout and don’t want to deal with supplementing, you’ll only pay your deductible plus the difference in the estimates.

Like an ACV policy, you can probably find a roofing contractor willing to do the work for the amount insurance gives you initially. However, there’s a reason they’re willing to do it for that amount when other companies aren’t.

How do you avoid scams when your roof has storm damage?

Now, you know what to do when a storm damages your roof in our area of Nashville, TN, and Middle Tennessee in general. The important thing is not to panic when you learn you have roof damage.

You have time to file a claim, and panicking makes you susceptible to the scams that bring the worst out in the roofing industry. The last thing I want is for you to fall for one of these scams.

That’s why I wrote another article breaking down the tips you and every Nashville homeowner need to avoid falling for scams and inadvertently committing insurance fraud.

Just remember that Bill Ragan Roofing is here to help and provide guidance if your roof is damaged after a storm. We’ve been dealing with storm-damaged roofs and insurance claims in Nashville, TN, for over 30 years while also providing first-class customer service and high-quality workmanship backed by a lifetime warranty.

Get a Free Quote and Roof Inspection for your storm-damaged roof by contacting us today.

Check out 6 Tips to Avoid Roof Damage Insurance Scams to ensure you don’t get taken advantage of by a company looking to make a quick buck.